From President Nixon’s “War on Cancer” to President Obama and Vice President Biden’s “Cancer Moonshot,” we as a society have poured time and resources into the quest for a cure. While we still have a long way to go, steady progress has been made in the areas of prevention, diagnosis, and treatment. However, as anyone who has faced cancer knows all too well, the side effects are not just physical; they’re financial as well.

As reported in The New England Journal of Medicine, “health care costs have risen faster than the Consumer Price Index for most of the past 40 years.” For this reason, a cancer diagnosis is often a double hit: It means serious health consequences on the one hand, and severe financial hardship on the other. Between doctor visits, lab tests, clinic visits for treatment, expensive medications, hospital stays, surgery, home care, and more, the bills begin to mount. Even with insurance coverage, an individual’s out-of-pocket costs can be astronomical. Coupled with a loss of income due to an inability or a curtailed ability to work, these expenses are enough to drive families into bankruptcy.

Financial Toxicity of Cancer

Known as “financial toxicity,” the problem can be as detrimental to a person’s wellbeing as the cancer itself. In a 2013 study at the renowned Fred Hutchinson Cancer Center in Seattle, researchers found that cancer patients were about 2.5 times more likely to declare bankruptcy as those without it. In a study published this year, the same team found that cancer patients who declare bankruptcy are more than 80 percent more likely to succumb to the disease. Those who recover their health may still face the loss of their homes, savings, and credit.

This precarious situation endangers not only the patient, but also the entire medical ecosystem, as hospitals are increasingly required to absorb the costs of care when individuals are no longer able to pay. It’s an issue that is likely to worsen as the price of older and new cancer treatments continues to rise—and as high deductible insurance plans become more common. The uncertain future of the Affordable Care Act only adds to the sense of anxietyamong both providers and patients.

Fortunately, a proactive approach can make a tremendous difference in managing the costs of care. Here are a few concrete steps the health care system can take to help relieve patients’ financial burden:

-

Look at the big picture to anticipate future expenses.

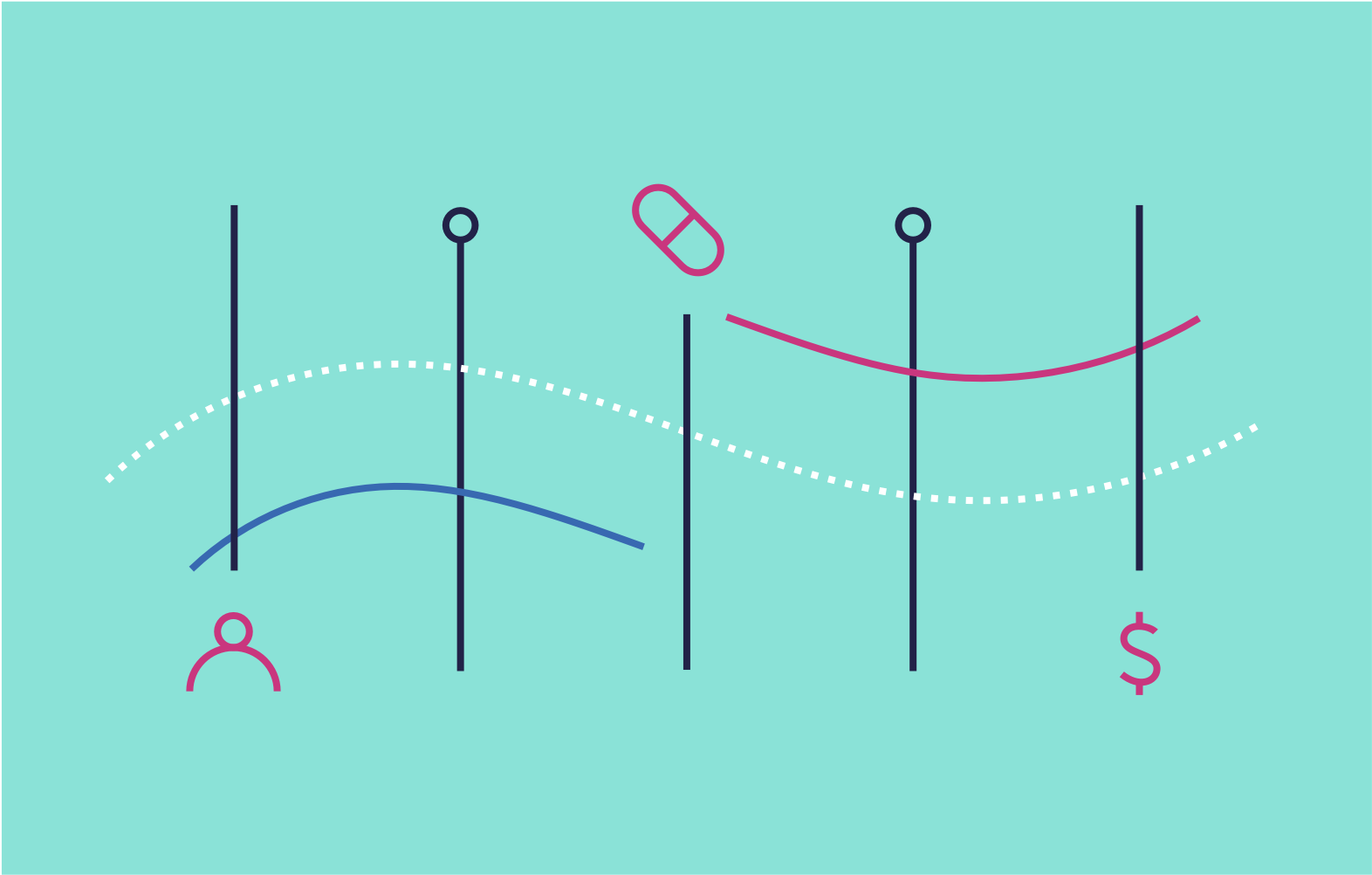

A cancer patient’s journey is complex, comprising many steps and crossroads, distributed over a period of months and even years. Each intervention has its own medical and financial impact. By looking at the overall trajectory from the outset, hospital staff can help patients enroll in assistance programs, optimize insurance coverage, and tailor treatment plans accordingly. By contrast, failure to plan ahead results in missed opportunities to lower costs and reduce financial distress. -

Leverage the power of financial navigation programs.

Many cancer centers are rightly enlisting financial counselors to help patients cope with soaring costs. Working closely with oncologists from the time of diagnosis, counselors take an individualized approach to address the complexities of a person’s particular illness and economic situation. Their services should be a standard component of holistic cancer care. -

Harness technology to maximize savings.

New financial management platforms can vastly improve counselors’ ability to identify cost-cutting opportunities. These platforms provide a dedicated tool to search the entire spectrum of insurance optimization, as well as public and private assistance programs. The software also ensures this information is accurate and up-to-date. By investing in this new technology, cancer centers can empower counselors to realize patients’ full savings potential.

Taking these actions may be the equivalent of throwing a life raft to patients who face an impossible choice: incur tremendous debt or go without critical medication. No one should have to walk away from lifesaving treatment because of an inability to pay. Through this blog, we look forward to building a community where all of us—hospital staff, advocacy groups, the pharmaceutical and tech industries, patients, and their families—can address this issue head-on. We hope you’ll visit this space often, and share your own experiences and ideas.

Together, we can fix the system, so that when loved ones tackle the side effects of cancer, financial devastation isn’t one of them.