In January, many Americans start the year with new calendars, new routines, and all too often, higher healthcare spending.

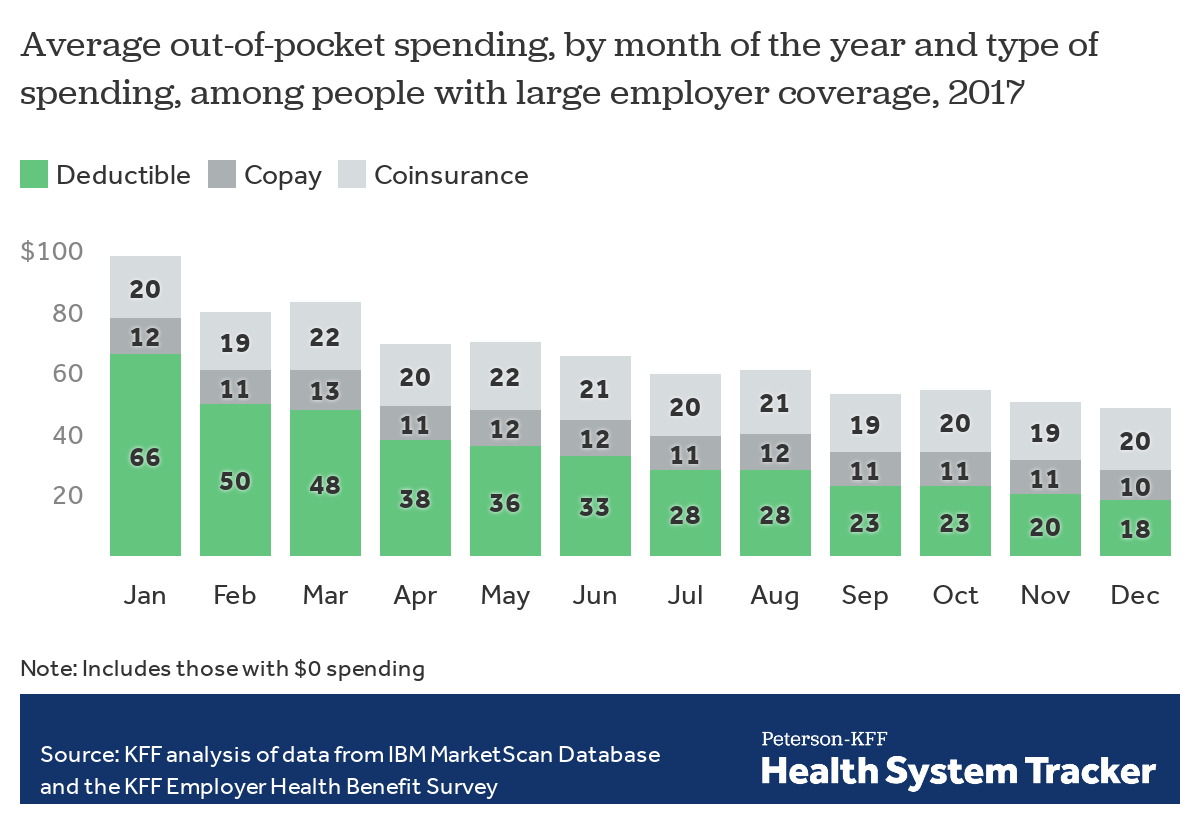

In recent years, high-deductible plans have become more common, leaving patients responsible for a greater share of their healthcare costs. If the plan has a calendar-year deductible, it resets to $0 on January 1. This means that even if a patient met their deductible in 2021, they must start from scratch at the beginning of 2022. For this reason, deductible spending tends to be highest earlier in the year. According to the Kaiser Family Foundation, out-of-pocket spending in January is double that of December—and deductibles account for two-thirds of January spending.

Coupled with rising prices of specialty medications and greater financial instability during the pandemic, deductible spending can create the perfect storm. These high, concentrated out-of-pocket costs at the beginning of the year place a significant burden on patients and families, especially those dealing with an acute or chronic illness. “This not only leads to financial hardship for patients and uncompensated care for healthcare organizations, but also impacts clinical outcomes as the result of treatment non-adherence,” says TailorMed CEO Srulik Dvorsky.

Here’s how providers and pharmacies can help patients overcome these challenges and maximize cost-saving opportunities:

1. Be aware and proactive to identify patients in need.

Recognizing potential gaps around healthcare affordability in January, providers and pharmacies should commit to addressing these issues on the front end. This means understanding that a patient who did not need financial assistance prior to 2022 may require it now.

“If a patient started treatment in the third or fourth quarter of 2021, it’s likely that they had already met their deductible and out-of-pocket limit,” explains TailorMed’s Director of Financial Navigation Clara Lambert. “When their insurance renews in January, they may need help affording care.”

Lambert says the beginning of the year is a good time to check in with patients who are in active treatment and reassess whether their needs have changed. By being proactive and identifying those who are at risk of financial distress, providers and pharmacies can reduce the likelihood that patients will delay or forgo necessary care.

2. Make the most of reopened charitable funds.

Fortunately, many charitable foundations, such as the HealthWell Foundation, Good Days, the Patient Advocate Foundation, and the Leukemia & Lymphoma Society, reopen patient assistance funds this month. “These national foundations often see increased philanthropy at the end of the year. They also recognize that the beginning of the year is a time of heightened need,” says Dvorsky. “For these reasons, we see a massive reopening of funds in January.”

Lambert and Dvorsky caution that many of these funds close quickly. In some cases, they may remain open for a day or two; in others, it may be as little as a few hours. That’s why it’s crucial for hospital and pharmacy staff to engage patients around their financial risk early on, build awareness about available funding, and prepare to enroll patients as swiftly and efficiently as possible.

In addition to disease-specific grants from larger foundations, there are also smaller, local organizations that offer financial aid to qualifying patients. Beyond charitable funding, manufacturer-sponsored free and replacement drug programs and co-pay cards are available throughout the year. January is an ideal time to investigate the full range of patient resources—including providers’ internal financial assistance programs—and maximize all potential opportunities to save costs.

3. Don’t forget about open enrollment.

This Friday, January 15, marks the end of the open enrollment period for ACA-compliant individual and family health plans. For patients without employer-sponsored health insurance, this is an excellent opportunity to enroll in an affordable plan. Lambert says that this year, consumers can expect to find more assistance and lower premiums compared to years past—thanks to the American Rescue Plan Act (ARPA).

Although the deadline is just a few days away, it’s not too late to help financially at-risk patients enroll in a marketplace plan that will help them afford care. “Anyone who’s eligible and hasn’t enrolled yet should take a look,” Lambert advises. To ensure that patients sign up for the most cost-effective plan, she recommends reporting any income changes as soon as possible. For the first time, enrollees won’t have to spend more than 8.5% of their income on a plan. And, in another first, those with incomes under 150% of the federal poverty level will be able to enroll during any month of the year in most states; these individuals will pay no premiums.

4. Automate and optimize the enrollment process.

While the beginning of the year presents numerous opportunities to reduce out-of-pocket spending, the process of enrolling patients in financial resources is often manual and cumbersome. Fortunately, digital tools have emerged to help reduce friction. By harnessing the power of data and predictive analytics, these platforms analyze a patient’s profile—including diagnosis, treatment plan, and insurance coverage—and project out-of-pocket costs for the entire medical journey. In this way, medical and pharmacy staff can quickly and proactively assess patients’ ability to pay their share of treatment costs.

Once a patient has been flagged for financial risk, technology can play a critical role in automating enrollment. For charitable funds, time is of the essence—given how quickly these programs close. While there may be less of a time crunch for enrollment in free and replacement drug programs and other resources, the sooner the process is completed, the less likely a patient will experience financial distress.

Software solutions enable a financial navigator, pharmacy technician, or care coordinator to easily find a list of relevant funding opportunities and select the most efficient enrollment method. These tools can also speed up the process of completing enrollment forms and significantly improve internal communications. The benefits include greater savings for the patient, as well as better financial performance for the provider or pharmacy.

Kick off the new year with a commitment to financial health

The beginning of the year is a time of both challenges and opportunities when it comes to removing financial barriers to care. With healthcare costs on the rise and high-deductible plans becoming the norm, it’s more important than ever to assess patients’ financial health—and intervene quickly. By taking proactive steps to flag patients in need, identify available funding, and expedite enrollment, providers and pharmacies will ensure that patients and families have the resources they deserve.

Let’s commit to doing everything we can to improve patients’ financial well-being, now and throughout the year. It’s a resolution that will make a big difference—in 2022 and beyond.

TailorMed Editorial Team